The introduction of the Goods and Services Tax (GST) in India brought about a major change in the taxation system of the country. GST is a comprehensive tax levied on the supply of goods and services, and it has replaced multiple indirect taxes such as Value Added Tax (VAT), Service Tax, Excise Duty, etc. For businesses operating in India, it is important to understand the GST law and comply with the regulations.

In this blog, we will discuss how the GST law applies to the Indian dry cleaning and laundry businesses. On an average, every business spends a major proportion of the working hours to calculate, maintain and update the tax payments every year. To simplify the taxation process, the Indian government has enforced the GST Law, but the lack of proper and complete information has made GST very complicated.

This article aims to help decoding GST law for India Dry Cleaning and Laundry Businesses so that every Dry Cleaning and Laundry business understands the basics of GST and to figure out the do’s and don’ts while implementing GST in your laundry and dry-cleaning business.

Every bill/invoice you issue to a customer must have:

-

- GSTIN

-

- Store Address

-

- Tax Structure (IGST/CGST/SGST)

-

- Label “Tax Invoice”

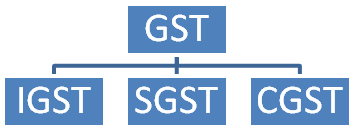

GST Bifurcation

GST has further been divided into 3 parts:

-

- IGST

-

- SGST

-

- CGST

IGST (Integrated GST): – applicable when service is provided by one state, and the consumption happens in another state. Dry Cleaning store is located one state and customer’s registered address with the business is in another state. On the invoice, it must be mentioned that collected tax is IGST along with its applicable rate (18%).

SGST: (State GST) – applicable when the service provider and customer are within one state, this portion is owned by the State authorities. On the invoice, SGST must be mentioned along with the applicable rate (9%).

CGST: (Centre GST) – applicable when the service provider and customer are within one state, this portion is owned by the Central authorities. On the invoice, CGST must be mentioned along with the applicable rate (9%).

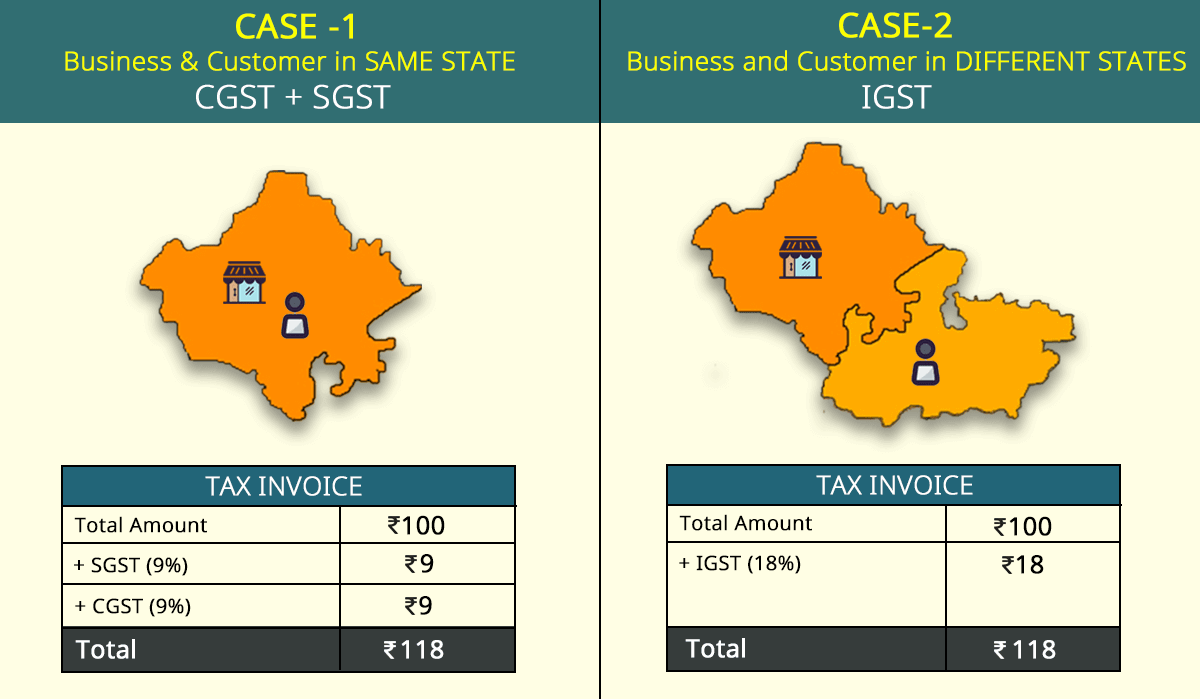

Application of Tax Bifurcations

A combination of resident state of your customer as well as your store location will determine the correct tax to be applied to the transaction and hence the same will be printed on the invoice.

Case 1: When the place of service provider (registered address of dry cleaning store) and place of consumption (customer’s registered address with the business) are within the same state then the tax collected has to be divided within Centre and State authorities. Current ratio of division is 50:50.

Case 2: When the place of service provider (registered address of dry cleaning store) and place of consumption (customer’s registered address with the business) are in different states then the tax collected would be called as IGST

Input Tax Credit

You can now take Input Tax Credit for all the payments that the business makes, against the tax collected, as per the following criteria:

-

- IGST – input credit can be availed against IGST, CGST and SGST

-

- CGST – input credit can be availed against IGST and CGST

-

- SGST – input credit can be availed against IGST and SGST

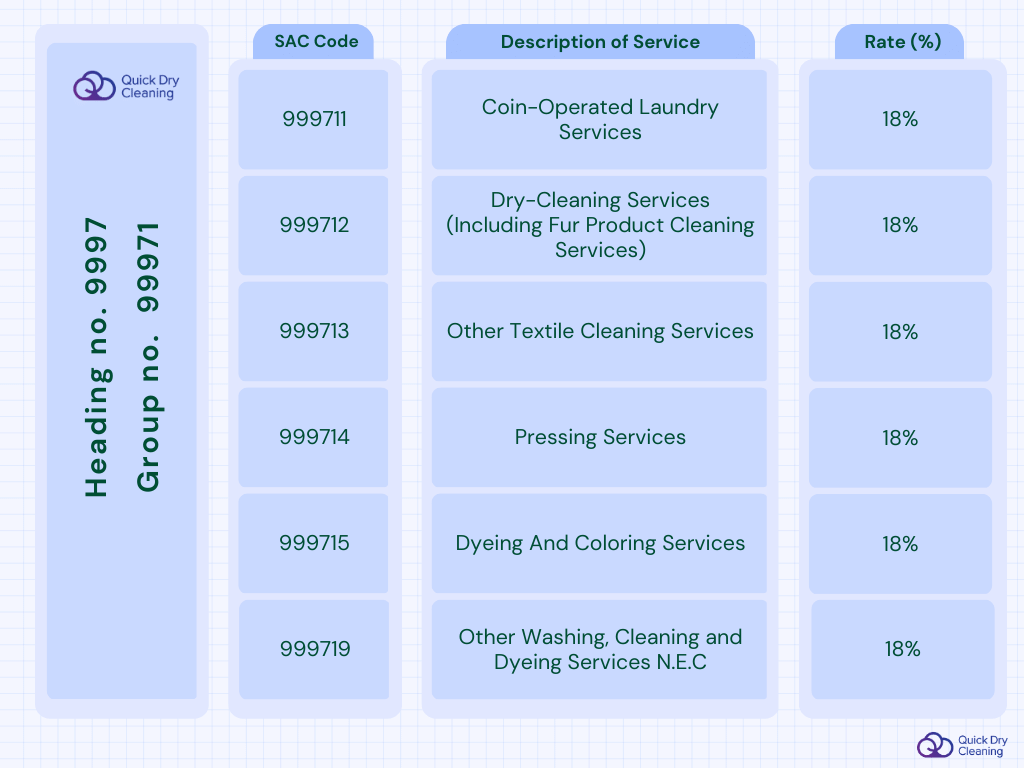

Classification of Services (Tariff Codes):

The Dry Cleaning, Laundry and other related services have been recognized by the government as follows:

Section 9: Community, Social & Personal Services and other miscellaneous services

SAC Code for laundry

SAC Code for laundry

Important dates for filing GST returns:

-

- 10th of every month for all your purchases

-

- 15th of every month for all the sales

-

- 20th of every month tax payment and final return for the month

-

- 31st December final return of the year

- 31st December final return of the year

These are the major guidelines you need to follow and implement in your dry cleaning and laundry business. GST implementation can be handled easily with the help of our GST Enabled Business Management Software. Start Free Trial NOW to automate GST in your Bills & Reports.